What is the State Small Business Credit Initiative?

The State Small Business Credit Initiative (SSBCI) is a program that was re-funded under the American Rescue Plan Act intended to “fund state, territory, and Tribal government small business credit support and investment programs.” The initial program funded in 2010 was only open to States, but this round included Tribes. You can learn more here.

How ATNI-EDC is Engaged

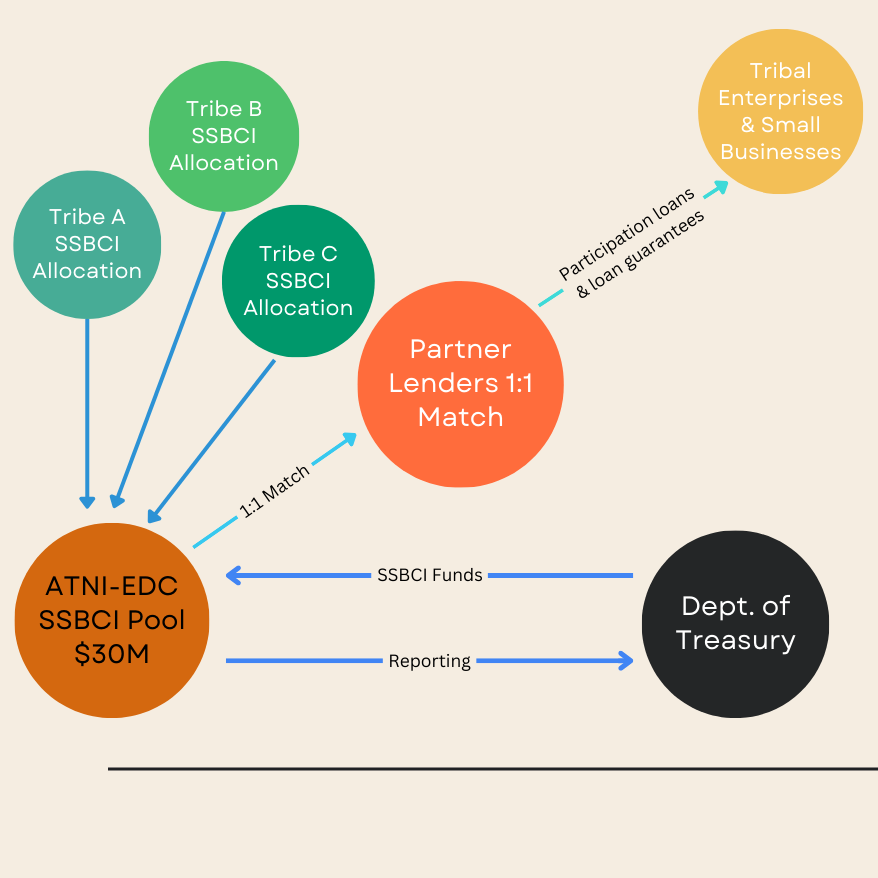

- ATNI-EDC Regional SSBCI Strategy: ATNI-EDC has formed a regional consortium of 36 Tribes where ATNI-EDC will act as program administrator.

- ATNI-EDC as Lender: For Tribes that are standing up their own SSBCI program, ATNI-EDC can be a lender through our CDFI, ATNI Financial Services.

- Technical Assistance: ATNI-EDC has applied for the SSBCI TA grant funding to bring business support to Indigenous-owned small businesses across the region.

Check out recent articles about our consortium:

- SSBCI Implementation Snapshot: State Small Business Credit Initiative for Tribal Governments – 12/7/23

- California Gold Rush Outpost Now in Native Hands – 10/19/23

- Treasury Department Announces First State Small Business Credit Initiative Awards to Tribal Governments for Small Businesses, Part of Biden Administration’s Investing in America Agenda – 6/26/23

ATNI-EDC Regional Strategy

ATNI-EDC is deploying a regional strategy to support Tribes. We have been working with various consultants to develop the regional strategy to support ATNI Tribal enterprises and Tribal-citizen owned businesses. You can download a presentation summary of the strategy by clicking here.

We will deploy 3 programs:

- Loan Participation to support small businesses

- Loan participation to support bridge financing for tribal enterprise projects

- 80% loan guarantee

Other Resources

SSBCI Website The SSBCI Website has up to date information and announcements. |